Thursday, April 30, 2009

McDonald's: From Market Leader To Market Laggard

Gold: On The Launching Pad

Key Price Levels: April 30, 2009

Monday, April 27, 2009

Airlines: Follow This Sector

Last week when the AMEX Airline Index (symbol: $XAL.X) spiked 10% for the day on so so but better than expected earnings out of Delta Airlines (symbol: DAL) and United Airlines (symbol: UAUA), I was so full of myself because just the week before I had highlighted the airline sector as a possible leader in the next bull market.

When I highlighted the sector as a possible market leader in the next bull run, I felt that it was important to have the overall market move higher in concert as a necessary tailwind to the development of this secular story. As I stated in this week's sentiment outlook, it is my belief that the market is putting in an intermediate term top. So maybe this is just profit taking in a bear market as selling fear is never a good strategy. Personally, I never put much credence in the "reason".

Regardless of today's action, the airline sector remains extremely important to watch. See figure 1 a monthly chart. A monthly close over the prior pivot low (noted with down red arrows) at 16.08 would be bullish. This would also be a close over a down trend line formed by two prior pivot highs. The "next big thing" (not shown) is in the zone where we expect a secular trend change.

Sunday, April 26, 2009

Investor Sentiment: The Same Story

Friday, April 24, 2009

Add These 2 Sectors To Your Watchlist

Wednesday, April 22, 2009

Key Price Levels: April 23, 2009

Figure 4 is a weekly chart of the i-Shares Russell 2000 Index (symbol: IWM). My previous comments on the IWM were: "The close above the pivot at 42.38 will likely propel prices to the 47.58 level, which is about 1 point away from the recent close. There is significant resistance in this region - a key pivot point and 2 positive divergence bars." This was correct. I also stated: "A weekly close above these levels would be significant and likely propel prices to the 40 week moving average." Last week, the IWM closed above the key pivot by 17 cents. Once again, context, context, context. Let's wait and see. On the downside, 42.38 should be support.

Figure 4. IWM/ weekly

11 Rules For Betting Trading

Airlines Act Like Market Leader

The airline sector is one of the sectors that I highlighted on April 16 in the article, "4 Sectors That Could Be The Next Bull Market Leaders". Figure 1 is a monthly chart of the Amex Airline Index, and as stated in the article:

"The price action has been bullish from two perspectives: 1) it seems likely that price will close the month above the down sloping, dashed trend line; and 2) this will be a close above a prior pivot low point (noted with red arrows). Closes below a pivot or a trend line that quickly reverse are bullish."

Figure 1. $XAL.X/ monthly

Yesterday's price pop was on narrower first quarter losses. Like many fundamental or economic data points over the past 2 months, the news is still bad but less bad than the prior numbers. And this for the most part would summarize the results from the airlines.

Delta's results missed the Standard and Poor's Equity Research estimates and their analysts lowered its full-year earnings estimate from $1.25 a share to $1.00 a share. However, it was their feeling that industry revenue had hit bottom. Adding to bottom line revenues would be an increase in fees charged to international passengers for a second bag. There was no mention of increasing passenger travel.

United's losses were also less than previously reported and analysts attributed this upside result "as better than anticipated cost performance". There was no mention of increasing passenger travel.

In summary, it is my belief that the airline sector has put in a bottom and could possibly be a market leader in the next bull market (that has yet to launch). At present, the news is less bad than before. Fundamentals have appeared to stabilize, and buyers have rushed in anticipating better times. Of course, stabilization only means that "things" are not getting worse. They are not necessarily getting better. Nonetheless, the long term technical dynamics appear to be improving (and changing) for the airlines sector.

Tuesday, April 21, 2009

On Investing Guidelines

As a rule based technician or quantitative strategist, I like guidelines. Guidelines are like signposts pointing the way to profits in the markets. I have my own list of guidelines, and I thought I would comment on some of Mr. Bernstein's that are so near and dear to me.

Mr. Bernstein's Guideline #2

"Most stock market indicators have never actually been tested. Most don’t work."

Hallelujah!! I have been saying this for several year now. But what is really amazing is not that most indicators don't work but investors continue to use them anyway.

I have given this a lot of thought as to why investors behave so irrationally. One, they haven't done their homework. Furthermore, it is really difficult to find something that "works" and if you do find something you are comfortable with, it will probably only work some of the time. Two, there is comfort in being part of the consensus. MACD, RSI, etc and all the other dribble is just that - dribble and nonsense. I wish it was so easy. But I think there is more to the consensus issue. To me, consensus also means mediocre and many market participants are mediocre, yet mediocre is great if you are managing tens of millions of dollars. Fund payment structures ensure that you don't have to be great to make money, but you do have to be exceptional to make your clients money. Many money managers have a vested interest in protecting their own interest. So if they do everything just like everybody else and fail, then they can blame the system. This was a refrain often heard in 2008 as "no one saw this coming".

Mr. Bernstein's Guideline #3

"Most investors’ time horizons are much too short. Statistics indicate that day trading is largely based on luck."

I don't know much about day trading, but I would agree that investors want to be investors but they tend to act like traders. And what happens? They too easily trade themselves out of strong trends. Investors should focus on longer term monthly charts and those markets making secular moves. Having the secular winds at your back can cover up a lot of mistakes.

Mr. Bernstein's Guideline #5

"Diversification doesn’t depend on the number of asset classes in a portfolio. Rather, it depends on the correlations between the asset classes in a portfolio."

Agreed! Finding assets classes to invest in that don't correlate is the difficult part. Asset allocation and diversification are very important and having non-correlated assets might even be more important.

Mr. Bernstein's Guideline #9

"Investors should research financial history as much as possible."

If investors did, then we wouldn't have to worry about Guideline #2. But they don't, so a lot of investors use tools ill suited for the job. Oh well. Of course, there will always be the person who says, "Yeah, that worked in the past. How do you know that it will continue to work in the present?" Well, you don't know. But I would counter that if you don't know what worked in the past, then you definitely won't know what works in the future. Do the work and you will be rewarded.

Monday, April 20, 2009

When Signals Fail

Sunday, April 19, 2009

Investor Sentiment: Time To Sell Strength And Tighten Up Stops

Thursday, April 16, 2009

4 Sectors That Could Be The Next Bull Market Leaders

Sunday, April 12, 2009

Copper: What's Up?

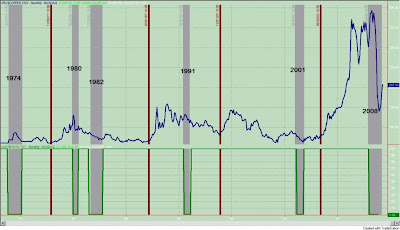

Of the six recessions since 1974, the current recession would be the only one that would see copper prices acting as a leading indicator. In fact, the most bullish price moves for copper occur late in the economic cycle not at the beginning. These bull markets in copper are noted by the maroon colored vertical lines.

The first thing we notice is that copper bounced at support or the breakout point (labeled with a "1") of the previous bull run. In other words, copper made a round tripper over the past 4 years. The bounce has carried 70% higher but right into the down sloping 10 month moving average. In other words, copper prices are behaving as they should. There was a breakout of historic proportions. Why did this breakout lead to such monstrous gains in 2005 and 2006? Because the breakout of historic proportions was 12 years in the making. In other words, the breakout was from a 12 year trading range. The current 70% move has the makings of a snapback or countertrend rally.

.png)

.png)

.png)