Saturday, March 28, 2009

Investor Sentiment: Neutral

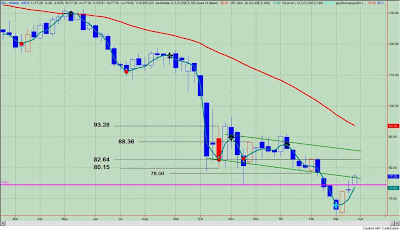

Figure 1. "Dumb Money"/ weekly

If the "Dumb Money" indicator remains neutral for 4 - 5 weeks while prices remain under their 40 week moving average, then there is a high likelihood that the market will rollover. I discussed these observations in the article, "Investor Sentiment: Some Context". Whether we roll over or push higher by the end of April is difficult to tell from this point, but I think it is very likely that lower prices should bring out the dip buyers and those still on the sidelines looking to get long because they missed their opportunity three weeks ago. In several weeks time, we will either be "selling strength" (i.e., hope) or riding the crest of a very bullish wave.

Tuesday, March 24, 2009

Treasury Yields: Intervention Breeds Uncertainty

Charts Of Interest: Follow Up

Original comment: EEM is one of the few ETF's forming a nice base. First off, EEM did not violate the quarter 4, 2008 lows at 20.45. This is our support level, and any weekly close below 20.45 would be an ominous sign. The initial upside is 25.50.

Key Price Levels: March 24, 2009

Please review the methodology and the significance of the key price levels by clicking on this link.

A weekly chart of the Diamond Trusts (symbol: DIA) is shown in figure 2. The DIA will likely close the week above the November, 2008 lows at 74.50 (horizontal pink line). There is resistance at the lower channel line and prices have yet to close above the prior key pivot point at 82.64. This move in the DIA still "smells" of a bounce into resistance.

Figure 3 is a weekly chart of the Power Shares QQQ Trust (symbol: QQQQ). The QQQQ is our best performer as prices have catapulted outside the upper channel line. A weekly close over the two upper pivots (at 30.33) would be considered a "breakout" in my book. The last "breakout" in early February was a fake out, but if this one "sticks", expect a melt up to $35 at the 40 week moving average.

Sunday, March 22, 2009

Investor Sentiment: Not A Factor

Figure 1. "Dumb Money"/ weekly

Friday, March 20, 2009

Semiconductor Sector: Potential For Secular Run

Figure 1 shows a monthly chart of the PHLX Semiconductor Sector Index (symbol: $SOX). The indicator in the lower panel is our "next big thing" indicator, and as we can see it is in that zone where a secular trend change is typically launched from. The "next big thing" indicator isn't so much a timing tool, and this can be seen by the vertical gray line when the indicator went into "the zone" back in 2002. This was early and prior to the ultimate bottom. Nonetheless, the indicator tends to identify the potential for a secular trend change. In other words, you have to be able to walk before you can run, and many assets will cycle through this phase. This is rather consistent across assets and time.This is not an indicator for the 10 minutes or 10 weeks. We are looking where I want to be for the next 10 months!

Figure 1. $SOX/ monthly

What does the indicator measure? While proprietary, I will say that the indicator measures as much on the y axis (i.e., price) as it does on the x axis (i.e., time). Most indicators and technicians just look at price; I am also looking at time.

Other technical tidbits are worth noting. See figure 2 a monthly chart. Prices are in the range of the August, 1998 and October, 2002 lows. Past bottoms were made in these areas. The indicator in the lower panel looks at the current price relative to past pivot points over a 36 month time look back period. The down trend (black line) of the indicator has been broken, which I interpret as the down trend in price being broken as well.

Figure 2. $SOX/ monthly

The technical evidence suggests that "the bottom" is in for semiconductors. The potential for a secular trend change is there. If the general market gains traction - a big "if" here as I view the current market rally as a counter trend rally in an ongoing bear market - then it would not surprise me to see the semiconductor sector providing leadership.

Wednesday, March 18, 2009

Key Price Levels: March 19, 2009

Tuesday, March 17, 2009

AIG Bailout: The Real Message

“We cannot attract and retain the best and the brightest talent to lead and staff the A.I.G. businesses — which are now being operated principally on behalf of American taxpayers — if employees believe their compensation is subject to continued and arbitrary adjustment by the U.S. Treasury.”

How often in the past months have we heard the same rational to justify the status quo on Wall Street?

"The best and the brightest" - hardly? These are the same people who drove their company into the ground, who almost brought the economy to a standstill, and who operated with no moral compass whatsoever.

The real message of "the best and the brightest" is this: We have locked the door. We have thrown the key away. We are not letting you in to our culture of being grossly overpaid for marginal performance. It is Wall Street doing whatever it can to protect its turf.

I seriously doubt that there is anything special about those who work on Wall Street. I am sure they are of normal intellect and abilities just like the rest of us who work on Main Street. And with the carnage in the markets over the past year where few went unscathed, I have no problem making such an assertion. There were few standouts amongst "the best and the brightest".

There once was a time when "the best and the brightest" pursued a calling like medicine or teaching. There once was a time when "the best and the brightest" were not only recognized for their abilities but also for their passion and ideals. Having ideals is not something most Americans would associate with Wall Street, and AIG's move to reward its executives for driving their company into the ground is an insult to all Americans who are "the best and the brightest" everyday. Wall Street and AIG needs to get on board and make the sacrifices -like the American taxpayer- to help resolve the financial crisis and many problems facing our country.

Sunday, March 15, 2009

Investor Sentiment: Still Bullish

Wednesday, March 11, 2009

Did You Miss The Boat?

Charts Of Interest

Sunday, March 8, 2009

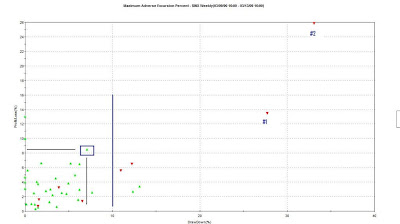

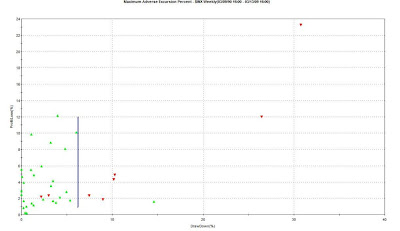

Putting A Bullish Signal In Context

So what does a bullish signal mean for equity prices? To assess the significance of a bullish signal, I will construct a strategy to buy and hold the S&P500 only during those times when investor sentiment, as measured by the "dumb money" indicator, is bearish (i.e., bull signal). So we "buy" the S&P500 when the "dumb money" indicator turns bearish (i.e., bull signal) and sell the position when the indicator moves to neutral. All signals are based upon weekly closing prices, and slippage and commissions are not considered in the results.

4) I hope I have demonstrated the importance of paying attention to extreme investor sentiment.

Investor Sentiment: Bullish Signals

Friday, March 6, 2009

Macro Thoughts By Guest Contributor

It's a quick read. Thanks Tyler.

To access the PDF, please follow this link: Macro Themes

Thursday, March 5, 2009

Jim Cramer Puts Foot In Mouth Again!

Before we get to another Jim Cramer "moment" let me state that I have no personal axe to grind with him, and in fact, as a former contributor to TheStreet.com, I am indebted to Jim Cramer for giving me a start and some credibility in the financial publishing business. I don't know the man, and I doubt he is even aware of my existence. I think he is genuine about helping investors, but I guess his downfall is that he must be a entertainer first and an analyst second. It is a tough job.

Where I take umbrage with Mr. Cramer is in the following CNBC "Mad Money" segment shown on March 3, 2009. Cramer calls technical analysis "hocus pocus", "voo doo" and "mumbo jumbo".

Gee, now I know why I don't get it right all the time. I was practicing "voo doo". I should have paid more attention to fundamentals. Not!

While I am not here to defend the art/ science of technical analysis, I believe folks have difficulty with TA because they expect it to be a science, but they really practice it like an art because they haven't done the homework to find what works and what doesn't. In my opinion, using tools and indicators that work fair at best will yield fair results. Using tools that you have no idea how they work is definitely a recipe for disaster. I suspect a lot of people use TA in this fashion.

The study of price movements (i.e., technical analysis) is the purest form of fundamental research. After all, everything that is known about an equity or an asset should be reflected in the price. Technical analysis also lends itself to rigorous analysis. One can easily quantify -if they do the homework - the significance of certain price movements. This doesn't mean that TA is always right, but it can easily improve the odds for success.

Wednesday, March 4, 2009

It's A New Era Of Thrift

This is a story of three successful "40 somethings" who are cutting back not because they have to but because they want to. They have given up on the markets -not because of losses - but because it has failed them. These people are cutting back because they sense a long period of economic malaise that won't be fixed by increased spending or a new bailout program. And they believe that the economic malaise and dislocations will result in opportunities far off in the future, and they want to be in position, with cash on hand, to take advantage.

Tom is a mergers and acquisitions lawyer who made over $300,000 in 2007. He started his own firm in 2008, but looking ahead, he projects that his billings will be down, and he expects to be making about two thirds of what he used to make. Furthermore, being the only boss is losing its appeal. Tom is looking to downsize. He is going to merge his firm with another, and he is moving from a bigger house to a smaller one. Even though he lost over 50% of his net worth last year, he knows that he could ride out the storm, but what is the point. Tom can live a lot simpler without all the stress, and he never wants to put himself in that position again where his financial well being is dependent upon others. Tom is pulling back on his spending and his investments not because he has to but because he wants to.

Pete is a children's dentist with significant and stable investments in rental properties. He really hasn't taken a hit on his income from the practice or his investments. Pete is cutting back because he has too much on the table; his balance sheet is leveraged more than he would like especially when he considers the prospects for the economy. Pete doesn't have to downsize but he wants to because he wants to improve his cash flow.

Steve is a successful physician with a stable salary. In fact, Steve's wife also is a physician, so they have two very stable salaries. Yes, they lost in last year's market, but with 15 years of productive work life ahead of them, they are not too concerned. While retirement is far off, Steve and his wife see the current economic dislocations as an opportunity to plan for the future. They would like to buy a retirement home with a view of the ocean. Prior to 2008, this was just a silly notion, but maybe, just maybe, they now think it is possible. Of course, this will require savings, which means they will be cutting back too.

So there you have it. Tom is downsizing to simplify his life. Pete is cutting back to improve his balance sheet. Steve is saving more because he recognizes that the current dislocations in the economy will create opportunities. These folks don't have to cut back but they want to, and this dynamic isn't recognized by the pundits on Wall Street. If you listen to CNBC, you get the sense that all our ills will be solved by one more bailout or if not one more, than the right bail out. I got news for you: that game is over. It doesn't matter anyway, I believe the dynamic has shifted in this country from spenders to savers.

Furthermore, the financial pundits seem to imply that savings is only for those on the bubble - those who have lost a job or might lose one as they are downsized by their company. But what I see and hear is that financial prudence is for those who have the means as well and have been somewhat immune to the recession. There is no question that people are cutting back, and it just isn' t people who are on the bubble or who live their life in fear. People with means are pulling in their horns too.

The financial markets have failed investors. There has been a tremendous transfer of wealth from Main Street to Wall Street. Investors have made "bubkus" in this decade, yet CEO's and insiders have made millions for driving their companies into the ground. Wall Street has done little for shareholders. Tom, Pete, and Steve recognize that if they had acted so irresponsibly in their professional lives they would have lost their right to practice medicine or law. They are disgusted with the markets and bailouts to help those who acted recklessly and irresponsibly. They have turned a deaf ear to the financial pundits who clamour on about the need for just one more bailout to fix everything. Tom, Pete and Steve are taking matters into their own hands. Wall Street matters little as the wheels for a new era of thrift have been set in motion.

Tuesday, March 3, 2009

Key Price Levels: March 4, 2009

Figure 4. IWM/ weekly

Anything Is Possible

Figure 1. S&P500/ monthly

My first thought was "oh my god" as the S&P500 closed below the September, 2002 low pivot. (See the yellow half oval in figure 1.) Could it be - a mega "M" type top? Using classical technical analysis, a break down of such a magnitude implies a price projection of 200 on the S&P500. Yikes!

Here is the math. The width of the base is approximately 600 S&P500 points. You take the break down point (~ 800 on the S&P500) minus the width of the base, and this yields a price projection of 200.

Seems improbable. But of course anything is possible.

Then I came across this video of Louise Yamada of Louise Yamada Technical Research Advisors who discusses the significance of this technical break, and she even suggests (forecasts?) that the S&P500 could reach 400. Wowser!

But what is interesting about Yamada's comments is not the technical "call" but the fact that she speaks about a "wealth destruction phase" that would be very similar to the early 1930's. My point here isn't to be an alarmist, but such projections really are scary. If they come to fruition, they will likely have important implications for all of us.

.png)

.png)

.png)