Take about 20 minutes and review the charts of the component stocks that make up the Dow Jones Industrial Index. The financials (AXP, BAC, C, JPM) are in a free fall. Only JPM remains above its 2002 lows.

The industrials (AA, DD) are basing after the fourth quarter free fall and are trading at their 1994 lows.

The pharmaceuticals (JNJ, MRK, PFE) are mixed. JNJ has gone nowhere for 7 years and while at the bottom of its range, it is not going anywhere soon. MRK is at the bottom of a 4 year range. PFE remains in a 7 year downtrend, but it has the technical characteristics of a stock that may lead to a secular trend change, so this is worth watching.

The conglomerates (GE, MMM, UTX) don't look so good either. UTX is the best of this lot as it holds above the 2002 lows. MMM is above its 2002 lows but it has broken a long term trend line going back to 1994. GE looks scary as it below the 2002 lows and appears to be in a free fall to $10.

The manufacturers (BA, CAT, GM) are up next. BA looks set to fall from its current price of $41 to the lows set in 1998 and 2003. CAT, which is now at $39, has a lot of support at $30. GM should be at zero, but Congress has seen otherwise. It does have the technical characteristics of a stock poised to end its downtrend, so I guess when you sum it up: GM isn't for the faint of heart.

The energy giants (CVX, XOM) broke down in July, 2008, and they recently retraced those loses to their down sloping 40 week moving averages. They are rolling over.

Retailers (HD, WMT) are retailers and going nowhere fast in this economy. HD is near its 2003 lows and it does have the technical characteristics of a stock that is poised for a trend change. Look for a bounce. WMT, despite being every one's favorite store, remains in the middle of an 8 year trading range. It is nowhere.

Technology (HPQ, IBM, INTC, MSFT) doesn't get me excited either. IBM is sitting at the bottom of a trend line drawn from the 1993 lows. INTC is back to the 2002 lows, which probably represents a good low risk entry point. The same can be said for MSFT, which is at the very bottom of an 8 year trading range.

Communication giants (T, VZ) aren't my cup of tea, but these stocks have bounced at their 2002 lows.

So who is left? DIS needs to base. KFT is at the bottom of a 5 year range near its all time lows. KO has done nothing for 10 years. PG has rolled over and is beginning a down trend.

That's 29 stocks, and not much happiness for investors.

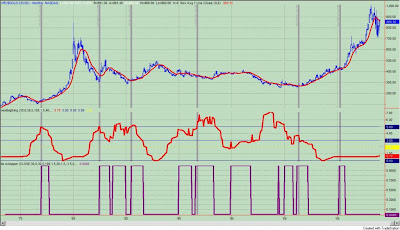

So who is missing and who is that "last man standing"? It is McDonald's Corporation (symbol: MCD). A monthly chart is shown in figure 1.

Figure 1. MCD/ monthly

So why do I call MCD the "last man standing"? MCD remains near its all time high, and it is the only stock in the Dow 30 that really has not been effected by the bear market. It is the "last man standing". I bring MCD up because I believe it is putting in a secular top and on its way to joining its breathren. The technical negatives for MCD include: 1) multiple negative divergence bars (pink markers on price bars); and 2) upward sloping trend line breaks. A close below the 10 month moving average should provide confirmation of a top with prices falling to $45.

MCD will not avoid the scourge of the bear market.

.png)